A salary certificate is an important document issued by an employer to their employees.

It contains vital information about the candidate’s pay and compensation structure. Salary certificates are useful in many scenarios such as loan applications, visa processing, tax filings, etc.

It also serves as proof of employment for the candidates so it is naturally important to understand the different components and importance of a salary certificate.

In this blog, we will take a detailed look at the different aspects of a salary certificate and uncover everything you need to know about this certificate. Without any further ado, let’s begin!

What is a Salary Certificate?

A Salary Certificate is an official document issued by the employer, containing details of what the employee has earned over a certain period. This usually includes a thorough breakdown of the information about the employee’s earnings.

It is usually printed on the company’s letterhead containing information such as the name and designation of the employee, basic pay, allowance, and deductions of the employee amongst other information about their salary structure.

The tenure of the employment might as well be specified in the certificate, which would routinely be sealed with the company seal and the signature of the authorised signatory.

A Salary Certificate is something every working-class individual should know about as it comes in handy quite often for different purposes.

It’s an important supporting document regarding the proof of source of income and job status; therefore, this document proves useful both in personal and professional life.

Salary Certificate vs. Salary Slip

A salary certificate is often confused with a payslip or salary slip. A salary slip is a detailed note of the pay and tax or insurance deduction.

On the contrary, a salary certificate is a document proof of one’s employment.

It shows the amount one is entitled to as wages and its complete breakdown. It is issued by the employer.

Salary slips are usually issued without any specific need in mind so they can be used in multiple scenarios wherever required.

A salary certificate, on the other hand, is most likely issued for one or another financial or bureaucratic use, for example, in credit applications, visa processing, etc.

Components of a Salary Certificate

A salary certificate contains much more information when compared to a salary slip so naturally there are more components to it.

Listed below are the different components of a salary certificate;

- Name and Gender of the Employee

- Company’s letterhead

- Employee’s designation

- Job Profile/Department

- Gross Salary

- Net Salary

- Deductions (if any)

- Allowances (if any)

- Date of Joining

- Cost to Company

- Company Seal

- Signature and contact details of the issuing authority

The exact information shared in a salary certificate might differ from one organization to another but overall some common important information is shared by all the organizations which have been mentioned above.

Importance of a Salary Certificate

A salary certificate is an important official document issued by employers that validates an employee’s salary and employment status.

Discussed below are some of the key points contributing to the importance of a salary certificate;

- Proof of Income – In many financial activities such as loans, mortgages, and credit card applications, the lending institutions need proof of income. A salary certificate can easily be provided in such cases.

- Employment Proof – A salary certificate can be used to prove an individual’s employment status and designation at work. It proves to be useful in many financial and legal dealings.

- Financial Planning – A salary certificate provides the employee with all the important financial information needed to plan their future accordingly.

- Legal Proceedings – In many legal proceedings taking place in a court of law, a candidate may need to present a salary certificate to prove their source of income.

- Taxes – An individual may need to submit a salary certificate when filing taxes or applying for tax deductions. As the certificate contains details about their annual income, it can prove useful in taxation scenarios.

Uses of a Salary Certificate

A Salary Certificate serves multiple purposes, especially in the professional and financial domains. Here are some of the key uses:

- Loan Applications – Lending institutions need proof of income before they can sanction a loan irrespective of whether it’s a home loan, personal loan, or a car loan. A salary certificate gives an insight into one’s financial conditions and helps lenders assess whether they can pay the loan back on time.

- Visa Processing – Many types of visa applications mandate the submission of stable proof of income especially if the stay abroad is going to be long. It helps the authorities determine a candidate’s financial ability to support their foreign stay.

- Rental Agreements – In many cases, landlords request a salary certificate along with other documents. It is used to determine the tenant’s ability to pay their rent.

- Credit Card Applications – Credit card companies can request a Salary Certificate to assess your creditworthiness and the extent of credit to be granted.

- Tax Filings – A salary certificate is used as proof of income in the filing of taxes, especially when there are discrepancies between declared income and actual income earned.

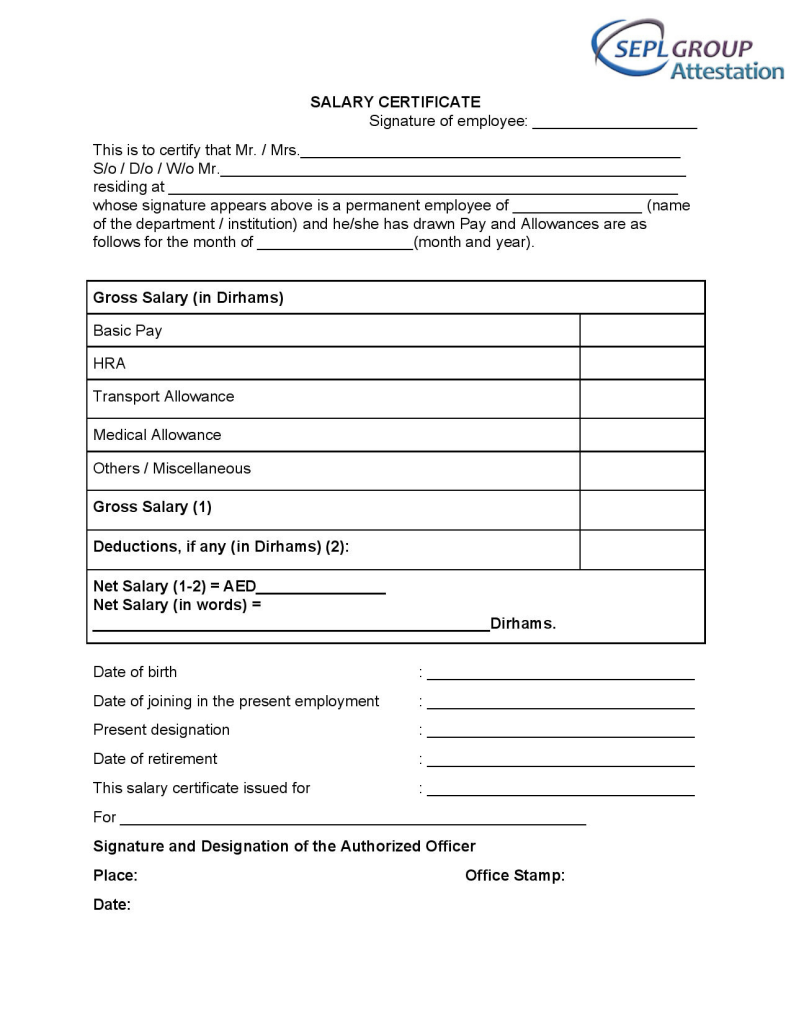

Salary Certificate Format

The format of a salary certificate can vary depending on the organization that is issuing it. In some organizations, the details provided may be more elaborate while not so much in others. Nonetheless, mentioned below is a common format for salary certificates;

The difference between a Salary Certificate, Salary Slip, and a Salary Letter

Candidates are usually confused and interchangeably use the following terms. However, there are subtle differences between them which is important to be understood.

| Salary Certificate | Salary Slip | Salary Letter |

|---|---|---|

| It contains information about an employee’s salary over a specific period. | It is a detailed breakdown of an employee’s salary showcasing benefits, allowances and deductions. | It is a formal letter stating an employee’s formal details. Usually, an employer releases this letter to be used in specific cases. |

| It is not referred to any specific person/organisation. It rather uses the “to whom it may concern” format. | It is not addressed to anybody at all. It is just a document with payment details. | A salary letter is specifically addressed to individuals/organisations for which the letter has been requested. |

| It is issued on special request usually to complete a specific task such as loan application, visa processing, etc. | It is issued regularly, usually monthly or at the time of salary payment. | Issued only on request from the employee for s specific task. |

Salary Certificate Attestation

An employee might need to get their salary certificates attested for a variety of reasons such as employment abroad, visa processing, international financial transactions, and so on.

It is important to get the salary certificate attested if the candidate is dealing with international authorities or institutions.

Since the salary certificate is considered a personal document, the following steps are to be followed for its attestation;

State Home Department Attestation – Salary certificates are to be attested first by the State Home Department. The certificate is then sent to the MEA for further attestation.

MEA Attestation – After further scrutiny, the MEA attests to the legitimacy and authenticity of the salary certificates by stamping the document with their seal.

Embassy Attestation – In the final step, the salary certificate is attested by the destination country’s embassy enabling it for use abroad.

Attestation is an important step if the salary certificate is to be used abroad as it guarantees the legitimacy and authenticity of the document making it suitable for use overseas.

Conclusion

To a salaried individual, a Salary Certificate is more than just a piece of paper; it is one of the tools that should be attached to many financial and legal transactions, whether in the home country or abroad.

Knowledge of its uses, significance, and reasons for attestation could not only be helpful but also go a long way in reducing the hassle in official matters.

Whether you are applying for a loan, want to get a visa, or plan on working abroad, proper attestation of the Salary Certificate is very crucial to make your financial and job status recognized and acknowledged.

Frequently Asked Questions

- Why is salary certificate attestation important?

Attestation of the salary certificate is important to prove the legitimacy and authenticity of the said certificate making it suitable for use overseas. It is important for various financial and legal reasons such as loan applications, visa processing, employment application abroad, etc.

- Who issues the salary certificate?

It is issued by the signatory authority for the company and mainly consists of the company’s HR/Finance Manager.

- How long does it take to acquire a salary certificate?

The time taken for a salary certificate to be issued depends completely on the organisation. However, it could be anywhere between 4-5 working days.

- Can a Salary Certificate be Attested in a Different State or Country?

Yes, it is possible to get a salary certificate attested in a different state or country. You need to contact expert service providers like SEPL Dubai.

- Which documents are required for the attestation of a salary certificate?

The candidates need to submit a set of documents to obtain quick and affordable salary certificate attestation. The following documents are required;

- Original certificate of salary

- Passport copy (for identification purposes)

- Other documents, if required by the attesting authority (for example, employment contract ).